Estimating Team Surplus in Jose Altuve’s 2013 Deal

In July of 2013, Jose Altuve agreed to a four-year contract extension with two club options for the 2018 and 2019 seasons that guaranteed $12.5 million and a $750,000 signing bonus. Now that the Astros have picked up the club option at $6 million for the 2018 season and will pick up the club option at $6.5 million for the 2019 season, the deal will end up totaling 6 years for $25.075 million (this figure includes $75,000 accrued in incentives). What is important to note about this extension is that the deal bought out all three of Altuve’s arbitration eligible years (2015-2017) at $2.5, $3.5, and $4.5 million respectively and through the club options, controls his first two years of free agency.

In 2013, Altuve was following a 2012 All-Star campaign where he slashed .290/.340/.740. However, at the time the deal was signed on July 13, 2013, Altuve had seemed to regress slightly hitting .280/.317/.671 through 86 games. Following the 2013 season, Altuve’s stock soared, culminating in an MVP 2017 when he led the majors with an 8.3 WAR.

(Image from sportingnews.com)

Looking back on this contract, the deal obviously resulted in a large team surplus; however, contracts like this have had mixed results in the past (think Allen Craig) so I must stress that the point of this article is not to bash Altuve for signing the deal or laud Jeff Luhnow and the Astros for getting this deal done when they did. The point of this article is, if we hold Altuve’s past performance constant, had Altuve not signed this extension and instead had gone the more traditional route of going through three years of arbitration then hitting free agency, how much could he have expected to make along the way? Although I could see this article going in many different directions, such as trying to assess the level of risk Altuve signed away in July of 2013 or, in a similar way, trying to quantify the amount of the risk the Astros took on by signing the deal (this risk is definitely magnified due to the fact they started the 2013 season with a payroll of just $22 million), I believe knowing what transpired over the last 6 years, calculating the surplus on this deal is that most interesting way to proceed.

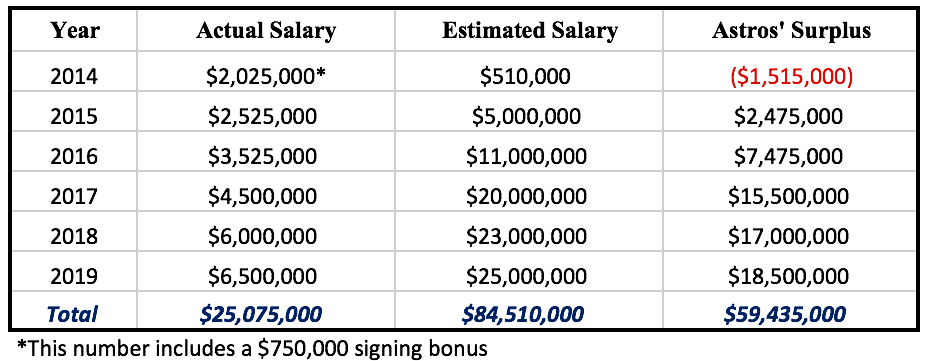

For the purpose of this article, I am assuming that Altuve worked on one-year contracts through the 2017 season when he would have hit free agency. I am also assuming that during each arbitration year, any of the three possible arbitration outcomes (player victory, team victory, or prior settlement before a hearing) could have occurred. To assist in keeping track of the many numbers presented in the remainder of this article, I have prepared the following table:

2013/2014 Offseason

Since Altuve would have been under team control, 2014 is the easiest season to estimate surplus and was clearly the most player-friendly year for Altuve. During 2014, Altuve’s salary jumped from the $510,000 he most likely would have received under team control to a $1.25 million base salary plus a $750,000 signing bonus and $25,000 in incentives. Hence, during the 2014 season, Altuve saw approximately $1.515 million dollars in surplus on this deal. For a player under team control, this number is pretty much unheard of, however, after 2014 is where the deal’s problems started.

2014/2015 Offseason

The 2014 season was clearly a breakout campaign for Altuve who hit .341/.377/.830 with 56 stolen bases and 225 hits. Since we are talking about his first arbitration-eligible offseason, it is important to keep in mind that Altuve’s .341 batting average and 225 hits both led the league. These more traditional statistics may not impress the sabermetrically savvy readers of FanGraphs, but the truth of the matter is that arbitration salaries are still very much reliant on these traditional metrics.

In the 2014/2015 offseason the largest contracts awarded to hitters who were arbitration eligible for the first time were Chris Carter ($4.175 million), Trevor Plouffe ($4.8 million), and Dayan Viciedo ($4.4 million; however, Viciedo was released at the end of Spring Training of 2015). None of these players are great comps for Altuve who only hit 7 home runs in 2014; however, they clearly set the market for top first-time arbitration eligible hitters. While someone like Carter may have hit 37 home runs and used this traditional measure of player value to push his deal up, Altuve did smack 47 doubles during the 2014 campaign and actually had an OPS that was 31 points higher than Carter’s (.830 vs. .799). I think a fair claim to make from this is that both sides would have seen tremendous value from Altuve and my estimate of a $5.0 million salary for a first-time arbitration eligible player is fair. This gives the Astros $2.475 million in surplus on the 2015 contract for Altuve who in reality received $2.5 million and $25,000 in awarded incentives. This changes the tide and brings the total surplus of the contract through 2015 at $960,000 in favor of the Astros.

2015/2016 Offseason

In 2015 Altuve was named to his third All-Star team and continued to impress, leading the league in hits and stolen bases for the second year in a row on his way to finishing in the top ten in MVP voting and winning a Gold Glove Award at second base. During the second year of arbitration salaries tend to jump up a lot, so after backing up his 2014 campaign with an even stronger 2015 season, a fair estimate for his 2016 salary is $11 million. Now, since Altuve ended up earning $3.525 million in 2016, assuming the $11 million salary is correct, the Astros’ surplus in 2016 was $7.475 million, making the total surplus of the deal through 2016 $8.435 million in favor of the Astros.

2016/2017 Offseason

I’m sure this will come as no surprise that Altuve backed up his All-Star 2015 campaign by leading the league in batting, increasing his home run total to 24, and finishing third in 2016 MVP voting. These are exactly the type of numbers that jump out of a presentation to an arbiter and due to the precedent of great value placed on high impact position players in their third year of arbitration, it is fair to assume that the 2016/2017 market would have been high on Altuve. Further evidence of this fact can be found in the 2017/2018 market that saw Josh Donaldson set the arbitration record by reaching a 2018 salary of $23 million. In addition, Bryce Harper settled on a 2018 salary of $21.625 million in May of 2017 after coming off a massive step back in production from 2015 to 2016 that saw him hit 18 fewer home runs and his on-base percentage to drop 87 points (Harper did rebound strongly during the beginning of 2017 right before this deal was signed). For these reasons, it is safe to assume that Altuve could easily have expected a 2017 salary of $20 million, leaving $15.5 million in team surplus and totaling $23.935 million in the deal.

2017/2018 Offseason: Free Agency!

Finally, a lot has been made over the free agent market this year, but the fact of the matter is that this past offseason Altuve would have been a 27-year-old reigning AL MVP hitting free agency. If the 5 year 151 million dollar extension he signed yesterday is any indication of the deal he would have received, I think 8 years at $225 million paying $23 million in 2018 and $25 million in 2019 is a conservative estimate. Based solely off this past year’s market, people may scoff at the length and dollar value of this deal, but the comparison of what Altuve’s situation would have been to the situations of this year’s free agent class are not strong due to the fact that the three main reasons this class struggled, do not pertain to Altuve. The first reason this past year’s free agent class struggled is that teams now have a better understanding of how players age and are not offering long contracts to players hitting free agency at 29 or 30 years old anymore. The second reason is that not enough teams are trying to compete for a playoff spot in 2018 due to the many rebuilds that are taking place. Because of this fact, there were fewer teams in the market submitting bids and driving up prices. The third reason is that lower WAR players who excel at putting up big numbers in traditional statistics like home runs (i.e Mike Moustakas) are finally being more fairly valued.

Being one of top players in the league at just 27 years old Altuve would have faced none of these problems even if only one team (say Milwaukee) had competed with the reigning World Champion Houston Astros to sign Altuve. The presence of just one other team in the market would have been enough to drive up the price making the Astros not afraid to pull the trigger on this big deal.

For the purpose of this article, the only two years we are worried about are the first two years (2018-2019), which are covered under Altuve’s actual contract at $6 million and $6.5 million. Thus, the Astros will receive $17,000,000 in surplus in 2018 and $18,500,000 in surplus in 2019, totaling $59,435,000 in surplus during the length of this 6-year contract. Talk about a team friendly deal!

(Image from clickhole.com)

Lastly, a quick note on what transpired yesterday. In my opinion, Altuve signing his second extension is a double down on the risk-averse behavior he first exhibited in 2013. Had he waited the two years until his current deal expired and hit free agency at age 29, teams once again may have shown the pattern of this past offseason and may not have been willing to give a 29-year-old more than a 5-year deal. Thus, Altuve’s contract way back in 2013 may have dealt his hand yesterday and forced him to sign this contract. The 2013 team friendly deal once again works perfectly for the Astros who were able to extend Altuve for five years while getting to take him off the books by his age 34 season.

The details on player contracts were taken from spotrac.com.

.

Excellent analysis. I’m curious about one thing though. Did you consider using comparison players at all to create your arbitration projections per year for Altuve? For example, looking at Dustin Pedroia’s early career extension in 2008? Or another young second baseman who went through arbitration and had similar early career success?It would have been interesting to look at those while accounting for inflation.

I don’t like delving into the financial side of baseball but this was interesting.